A crypto market rally could be coming as a senior Federal Reserve official made the case for more interest rate cuts in the December meeting.

Summary

- A crypto market rally could happen as a senior Fed official makes the case for rate cuts.

- Christopher Waller is more concerned about the labor market.

- Rate cuts and the end of QT are highly bullish for Bitcoin.

Bitcoin (BTC) was trading around $86,300 at last check on Monday, down by about 0.7% for the day.

However, altcoins like Ripple (XRP), Stellar (XLM), and Hedera (HBAR) were in an uptrend. See below.

| CRYPTOCURRENCY | PRICE | 24-HOUR GAINS +/- |

| Bitcoin (BTC) | $86,300 | -0.7% |

| Ethereum (ETH) | $2,837 | -0.1% |

| Solana (SOL) | $130 | -0.5% |

| XRP (XRP) | $2.10 | +1.7% |

| Stellar (XLM) | $0.2476 | +2% |

| Hedera (HBAR) | $0.144 | +0.5% |

Waller calls for more interest rate cuts

A potential catalyst for the crypto market rally is the growing liklihood that the Federal Reserve will cut interest rates in the December meeting.

These odds jumped to 70% on Polymarket after New York Fed’s John Williams supported a cut in a statement on Friday.

In another statement on Monday, Federal Reserve Governor Christopher Waller indicated that he was advocating for a cut due to the ongoing labor market crisis and where the unemployment rate has risen recently:

“My concern is mainly labor market, in terms of our dual mandate. So I’m advocating for a rate cut at the next meeting. You may see a more of a meeting-by-meeting approach once you get to January.”

Another rate cut, combined with the end of quantitative tightening, will be bullish for the stock and crypto markets. Historically, these assets tend to do well during periods of easy monetary policy.

However, the upcoming meeting will be notable as the rate decision will be determined by two officials. Already, some members, like Beth Hammack and Michael Barr, have voiced concerns about cuts, noting that inflation remains elevated.

More catalysts for a crypto market rally

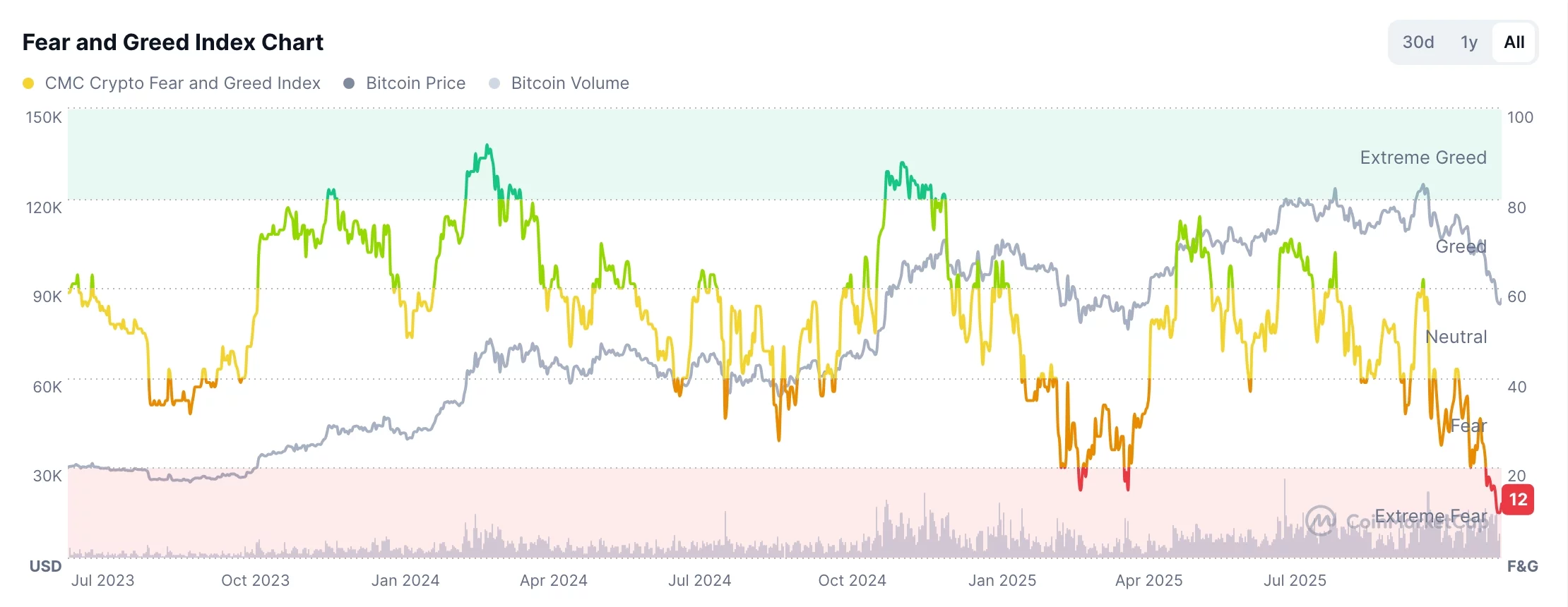

There are some more bullish catalysts for a crypto market rally. First, the Crypto Fear and Greed Index has slumped to the extreme fear zone of 12, its lowest level this year. This view is also reflected in the negative headlines about crypto in mainstream publications like the New York Times and Bloomberg.

Historically, this negative sentiment happens before a bull run starts, as the Fear and Greed chart below shows.

Second, top whales have used this dip to accumulate. A good example of this is BitMine, which has continued to buy Bitcoin. Michael Saylor’s Strategy has also continued buying and now holds nearly 650k Bitcoins.

Additionally, the crypto market rally could happen once leverage starts flowing back into the industry. One reason for the crypto crash has been the decline in open interest, which fell from $225 billion in September to $123 billion today. History shows that open interest usually rebounds after crashing.