Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

Institutional investors poured around $50 billion into crypto ETFs this year. Fortune 500 blockchain adoption hit 60%. Major exchanges like Coinbase reported record revenue. The narrative is clear: crypto has finally achieved mainstream legitimacy.

Summary

- Web3 growth is inflated: Up to 70% of reported users and marketing spend are bots or Sybil wallets, not real humans.

- The economics are broken: True user acquisition costs are 2–5× higher than reported, and most airdrops reward fake or extractive actors.

- Verification is now essential: Web3’s next winners will be projects that prove real human usage, not those optimizing vanity metrics.

But there’s a number missing from that story: one that should terrify everyone betting on web3’s growth. Only 30% of web3 marketing budgets actually reach real humans. The remaining 70% evaporates into bot farms, Sybil networks, and automated arbitrage schemes.

And here’s what makes it worse: 65% of users who sign up never become real users at all. They’re wallet downloads, automated transactions, and fake engagement — the digital equivalent of paying for a concert where 70% of the audience is cardboard cutouts.

Institutional investors aren’t just betting on blockchain technology anymore. They’re betting on user metrics that don’t exist.

The crisis nobody wants to discuss

When Web3Quest analyzed verification data across major crypto projects in 2025, we discovered something that contradicts every bullish narrative in the industry.

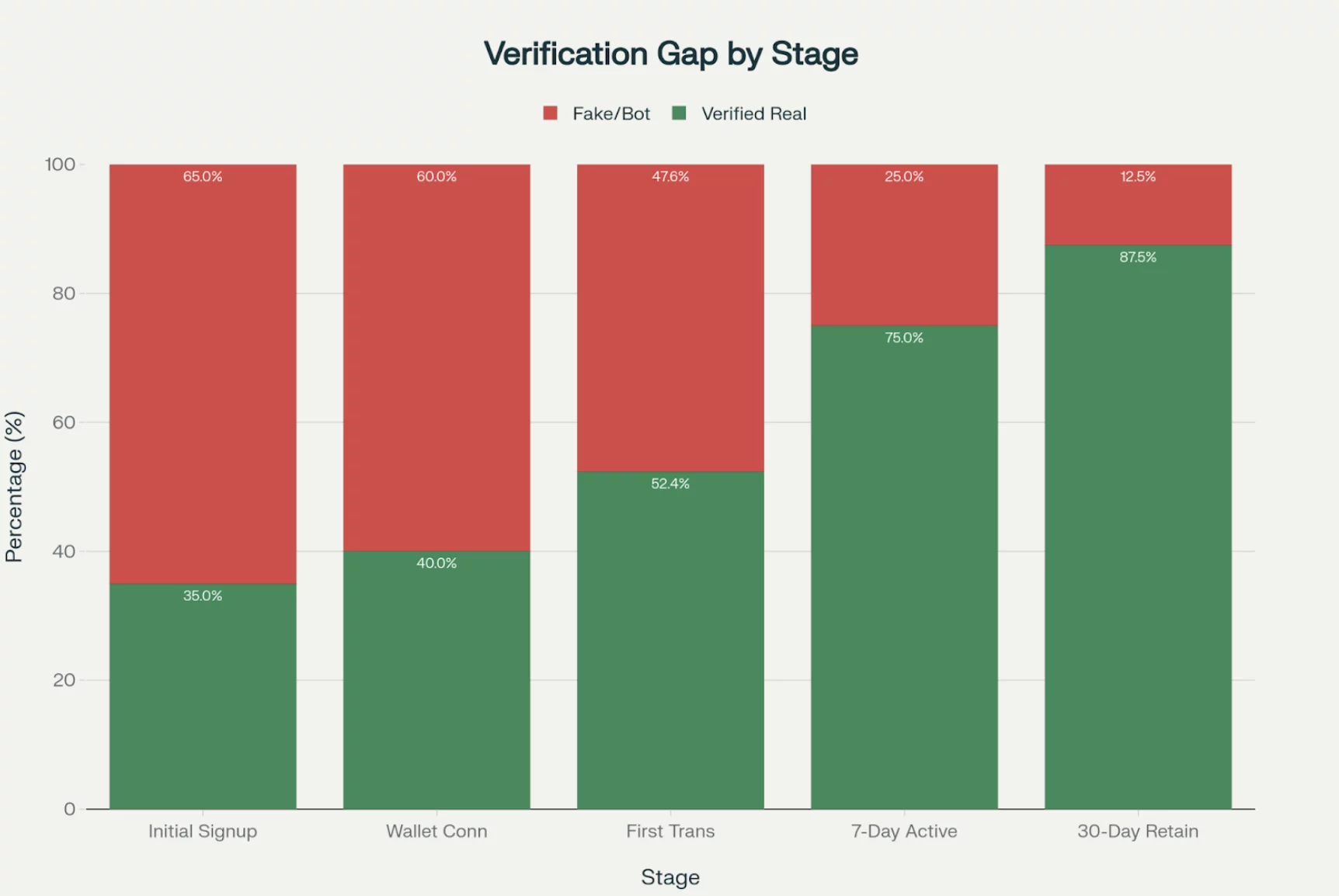

The verification gap is catastrophic:

| User acquisition stage | Total users recorded | Verified real users | Fake/bot users |

| Initial signup | 100% | 35% | 65% |

| Wallet connected | 70% | 28% | 58% |

| First transaction | 42% | 22% | 48% |

| 7-day active | 20% | 15% | 25% |

| 30-day retained | 8% | 7% | 12.5% |

What this means: A project that reports one million users has actually acquired roughly 350,000 genuine humans. The other 650,000 are bots, duplicate wallets, and automated engagement systems.

But project founders aren’t lying in their decks to investors. They genuinely believe their metrics, because nobody’s measuring real users. Everyone’s measuring reported users.

This isn’t fraud. It’s a systematic delusion at scale.

The real cost of fake adoption

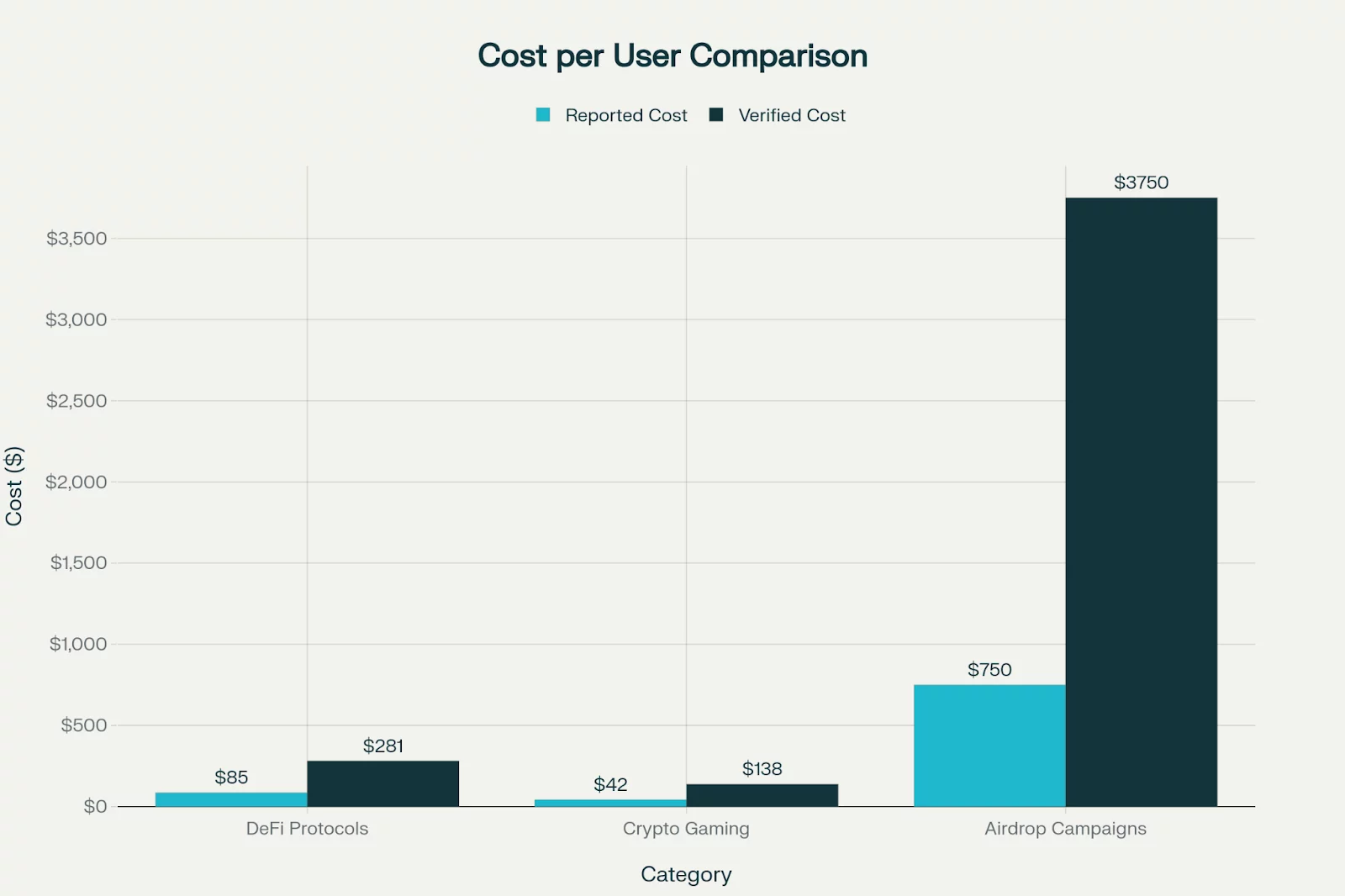

Here’s where it gets expensive for institutional capital. When you adjust user acquisition cost (CAC) to account for verification, the economics of web3 become almost unrecognizable:

| Category | Reported cost per user | Verified user cost (post-filtering) | True CAC multiplier |

| DeFi protocols | ~$85 per user | ~$281 per verified user | +230% |

| Crypto gaming | ~$42 per player | ~$138 per verified player | +228% |

| Airdrop campaigns | $500–$1,000 per user | $2,500–$5,000+ per human | +400–500% |

Projects aren’t overspending on acquisition. They’re undercounting their true spend by including non-human metrics in the denominator.

When Coinbase reports a user milestone, it’s counting wallet installs. When a VC fund evaluates a protocol’s growth, they’re seeing total signups. Nobody’s asking: How many of these are real?

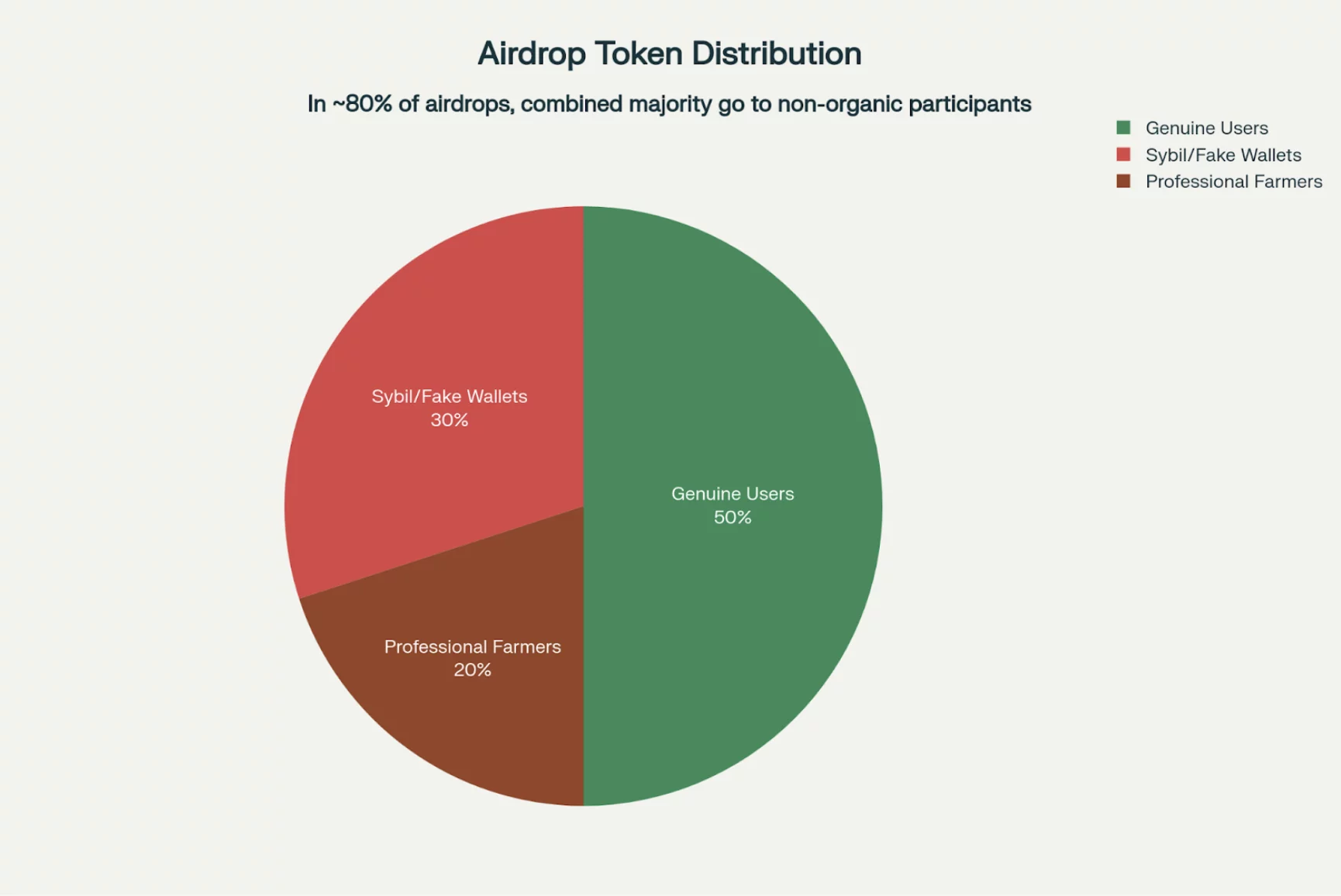

Where tokens actually go

The airdrop market has become a particularly grotesque window into this problem. Our monitoring of major 2025 airdrops reveals:

| Recipient category | % of tokens distributed | Reality |

| Genuine users | ~50% | Intended community recipients; real economic value |

| Sybil/fake wallets | ~30% | Bot networks with zero engagement intent |

| Professional farmers | ~20% | Sophisticated hunters who dump immediately |

In approximately 80% of airdrops, the combined majority of tokens go to non-organic participants. Projects aren’t building communities. They’re subsidizing bot infrastructure and funding arbitrage networks — and paying for the privilege.

Meanwhile, institutional capital sees “user acquisition” and thinks “community building.” They see “token distribution” and assume “ecosystem alignment.”

They see metrics. They don’t see reality.

Why institutions should be terrified

Here’s the thing that should wake up every Fortune 500 CFO writing blockchain checks: Projects without real-time verification waste 65–70% of acquisition budgets on bot activity and Sybil farms. Yet only 5–10% of onboarded users become repeat dApp users within 30 days.

This means:

- The headline growth metric is a mirage.

- The actual engaged user base is 1/7th of the reported size.

- The true cost of acquiring a real user is 2–5x higher than stated.

- Retention crisis suggests most onboarded users were never human to begin with.

When a GameFi project reports two million downloads but fewer than 50,000 are daily active users after 30 days (a 97.5% drop-off), that’s not a product problem. That’s a metric problem.

And institutional capital cannot make confident decisions on compromised metrics.

The verification imperative: A moment of truth

The web3 industry stands at a crossroads — and 2026 will determine which path it takes.

Option A: Continue the theater. Project teams keep reporting metrics that assume every wallet is human. VCs keep using those metrics to benchmark performance. Institutions keep allocating capital based on numbers that don’t reflect reality. The space continues to grow, but nobody — not even founders — actually knows what’s real.

Option B: Embrace verification. Projects implement real-time user verification infrastructure. Airdrops are distributed to verified humans. Retention metrics start meaning something. Institutional investors finally have reliable data. The 2026 crypto cycle rewards projects that solve verification, not just growth hacking.

The projects winning in 2025 aren’t those spending the most on user acquisition. They’re the ones distinguishing real humans from artificial engagement before the marketing budget bleeds out.

Hyperliquid didn’t airdrop tokens. It built an infrastructure so strong that real users migrated there naturally. And it has lower bot-to-human ratios than projects that spent 10x more on acquisition.

That’s not luck. That’s the difference between measuring engagement and faking engagement.

The institutional question

Here’s what every Fortune 500 executive and institutional investor should be asking right now: If I cannot verify that 70% of a crypto project’s reported users are actually human, why am I confident in my capital allocation? The answer is: You shouldn’t be.

The web3 space has achieved mass adoption of reporting metrics without achieving mass adoption of verifying them. And institutional capital is flowing into this gap at $50 billion per year. That gap needs to close — not because crypto is good or bad, but because confidence in infrastructure requires auditability. You wouldn’t invest in a bank that couldn’t prove its deposits were real. You shouldn’t invest in a blockchain ecosystem that can’t prove its users are real.

The next phase of web3 adoption won’t be led by projects spending the most on marketing. It will be led by projects that solve this: How do you acquire verified users at scale? How do you measure their real engagement? How do you prove it onchain?

And the ones winning in 2026 will be those bold enough to start by admitting their current metrics aren’t.