LUNC price remained in a tight range as market participants reacted to Do Kwon’s guilty plea in a U.S. court on Tuesday and the network’s ongoing token burn.

Summary

- LUNC price was stuck in a tight range as most cryptocurrencies surged.

- Do Kwon pleaded guilty to fraud charges in the United States.

- LUNC has formed an inverse head-and-shoulders pattern on the 4H chart.

Terra Luna Classic (LUNC) token moved sideways and was trading at $0.000062, down by nearly 5% from its highest point this month. This performance could be calm before the storm as it has formed a highly bullish chart pattern.

LUNC price forms inverse head-and-shoulders pattern

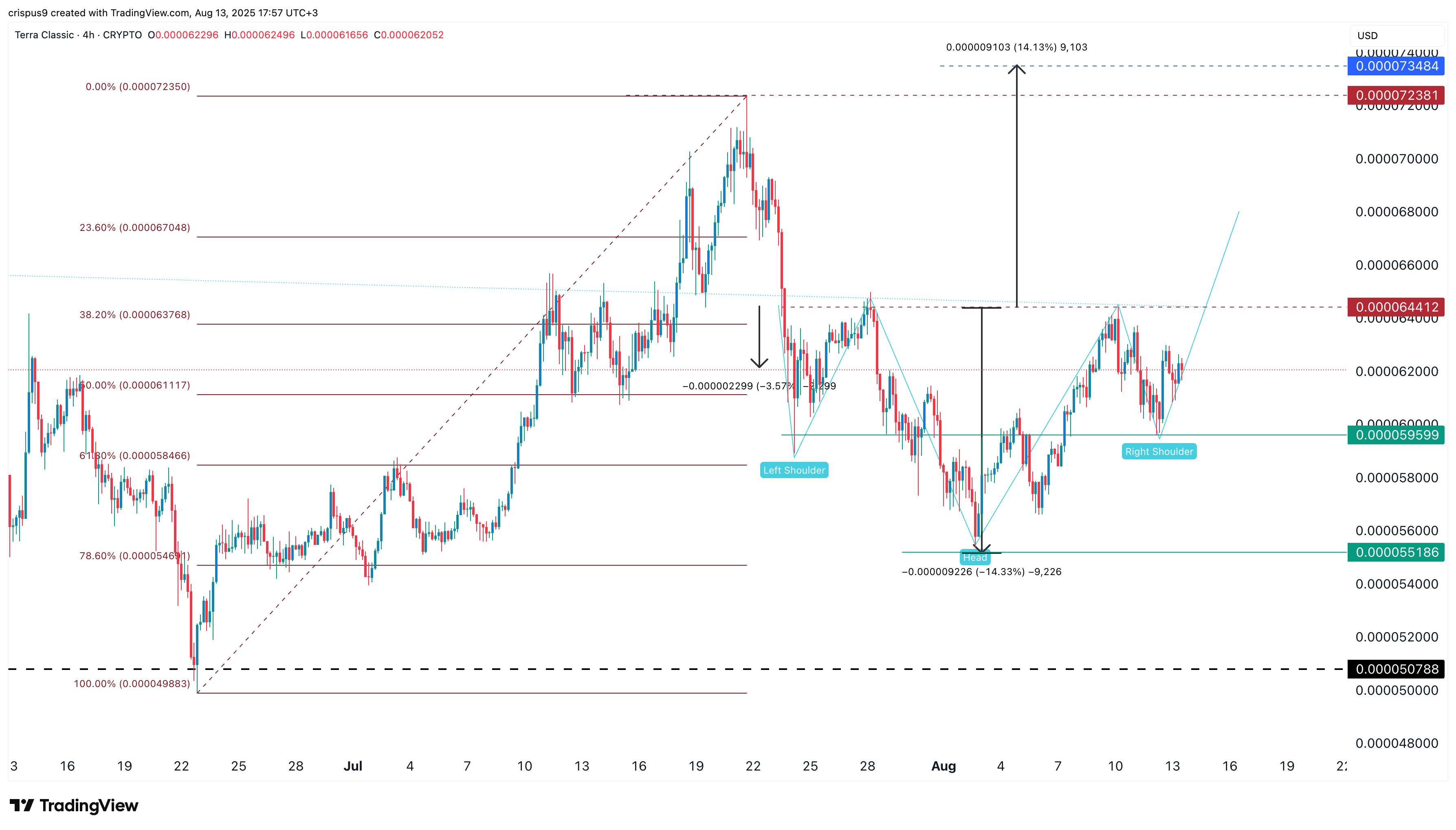

On the four-hour chart, LUNC peaked at $0.00007235 in July before pulling back as bullish momentum faded. Recently, the token has formed an inverse head-and-shoulders pattern, with the head at this month’s low of $0.00005518 and shoulders around $0.000059.

This pattern’s neckline is at $0.00006440, where it failed to move above on July 28 and August 10. Therefore, a move above that level will confirm the bullish LUNC price forecast and point to more gains, possibly to the July high of $0.00007235.

The distance between the pattern’s neckline and the head is about 14%. Measuring the same distance from the neckline gives the target price at $0.00007350.

A drop below the shoulders section at $0.00005960 will invalidate the bullish Terra Luna Classic outlook.

Dow Kwon guilty plea and Terra Classic token burn

The main catalyst for the LUNC price this week was Do Kwon’s decision to plead guilty to wire fraud charges. This case centered on the $40 billion collapse of Terra and its ecosystem.

Kwon faces up to 12 years in U.S. prison and potentially more in South Korea, where he also faces charges related to Terra’s collapse.

His legal troubles are unlikely to impact LUNC directly, as he has had no involvement in the project since its collapse. LUNC has since been taken over by the community, while Kwon launched Terra 2.0.

Meanwhile, token burns continue to support LUNC’s long-term outlook. More than 836 million tokens were burned in the past seven days, bringing the cumulative total to 415 billion. Burns reduce circulating supply, making the token more deflationary and potentially supportive of higher prices.