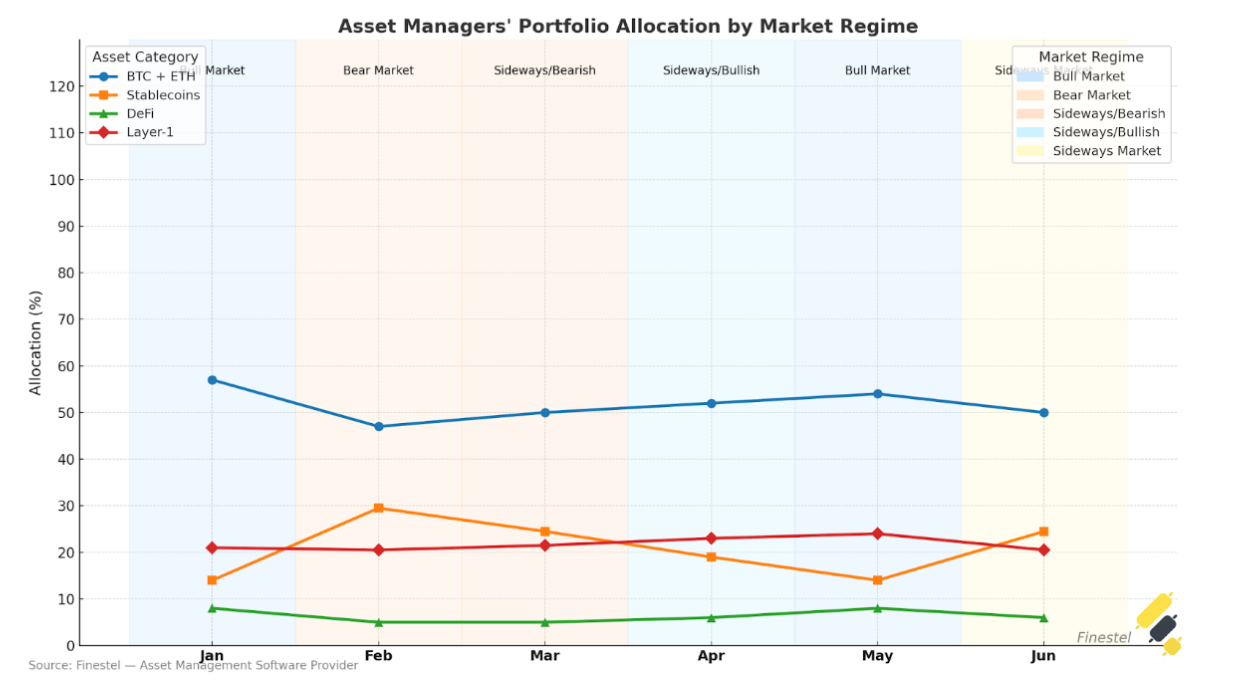

Crypto fund flows indicate that stablecoins surge to nearly 30% in sell-offs, while Bitcoin and Ethereum remain steady at around 50% across cycles.

When markets turn bullish, risk appetite often follows. That’s arguably one of the clearer takeaways from a recent allocation breakdown based on trading activity on Finestel, a crypto trading and portfolio-management platform that appears to help asset managers automate trading and oversight across Binance, Bybit, KuCoin, OKX, and Gate.io.

According to data compiled by the platform and shared with crypto.news, top managers tend to lean into “core” cryptocurrencies — mainly Bitcoin (BTC) and Ethereum (ETH) — when prices are climbing.

In January, as Bitcoin rallied toward $73,000 and Ethereum soared following the Pectra upgrade, BTC and ETH made up 57% of portfolio holdings, the data show. At the same time, allocations to Solana (SOL), Avalanche (AVAX) and other layer-1 tokens climbed to 21%. During the same timeframe, stablecoins dipped to 14%, which some might call a clear “risk-on” stance.

By May, that setup hardly budged. BTC and ETH together accounted for 54%, with layer-1s at 24%, DeFi at 8%, and stablecoins at 14%. That might suggest that, in strong up-markets, managers keep a steady overweight in core tokens and key smart-contract chains.

The mood appeared quite different in February, when BTC and ETH allocations fell to about 47%, down 10% from January. At the same time, stablecoin holdings nearly doubled to almost 30%. During that pullback, managers appear to have relied on Tether (USDT) and USD Coin (USDC) for liquidity and downside protection. Exposure to high-beta DeFi assets reportedly dropped from 8% to 5%, while layer-1s eased to around 20.5%, preserving what the report calls “dry powder” for when markets calm.

Risk-managed baseline

When markets moved sideways — in March, April, and June — allocations appeared to be relatively balanced. In March, for instance, BTC and ETH held steady at 50%, stablecoins sat at 24.5%, and DeFi and layer-1 hovered around 5% and 21.5%, respectively. That mix seems to reflect a cautious reentry into yield strategies as volatility cooled.

April brought another mild shift toward risk. As price action teased new highs, BTC and ETH rose to 52%, DeFi inched up to 6%, and layer-1 tokens climbed to 23%. Stablecoins fell to 19%, blending momentum plays with income generation.

By June, after a mild sell-off, portfolios had reverted to a structure resembling that of March. Bitcoin and Ethereum were back at 50%, stablecoins at 24.5%, DeFi at 6%, and layer-1 at 20.5%. That return to a more defensive posture suggests managers remained cautious about upside after the earlier rally.

Finestel’s report emphasizes three themes that appear consistent across all regimes:

- Core Consistency. Bitcoin and Ethereum appear to be anchoring roughly half of most portfolios, serving as what the report refers to as a “risk-managed baseline.”

- Dynamic Dry Powder. Stablecoins fluctuate between 14% and 30%, offering tactical liquidity to buy dips or hedge against market downturns.

- Selective Growth. Allocations to DeFi and layer-1 expand in bullish or cooling phases, aimed at harvesting yield or tactical alpha, but get trimmed when markets turn risk-off.

Of course, these figures aren’t one-size-fits-all. The report doesn’t identify specific firms or their performance targets, and it’s unclear how rebalancing frequency or fee structures might affect the results. For everyday investors, it obviously isn’t a plug-and-play playbook.

And yet, Bybit‘s numbers from a recent research report tell a similar story, with a twist though. They show that Bitcoin’s slice of everyone’s wallets has been climbing, now almost 31%, up from about 25% back in November. Even with all the ups and downs this year, people continue to come back to BTC as their go-to.

At the same time, XRP has quietly moved into third place among non-stablecoins, nudging out Solana, whose share has dropped by about a third since last fall. And it’s not just regular traders doing this. Institutions have nearly 40% of their holdings in Bitcoin, compared with about 12% for retail investors, showing how BTC is both a crowd-pleaser for everyday buyers and a macro hedge for the big players.